I shared this reflection at Interfaith Communities United for Justice and Peace and gave them postcards to send to their elected officials. If you aren't happy about how your tax dollars are being spent, I suggest you do the same. Meanwhile, here are my thoughts about taxation.

Most Americans don't like taxes, for lots of reasons. Surveys indicate that half

of Americans think they are overtaxed, and around 4 % think they are under-taxed.

Most Americans believe that 40% of the taxes they pay are wasted; and they may

be right, if you consider the military a waste of money. Historically, taxes have been association with

war and governmental oppression. “No taxation without representation,” was the war

cry of American revolutionaries. Empires from Rome to Peru taxed their citizens

to finance armies and wars.

But

taxes also have a beneficial aspects, especially in democracies where citizens

can decide how they want their taxes spent. Taxes pay for education, health

care, housing and infrastructure like roads and bridges. Europeans are taxed

more than Americans, but don’t mind as much since they actually get many

positive benefits. In his book “United States of Europe,” T.R. Reid says:

Beside universal health care, the typical European also gets

a lot more for their taxes – including a free university education, paid

maternity and paternity leaves for everyone, clean and efficient public

transportation, retirement security for all, and so on. So ironically, the

reason many people in the U.S. hate taxes more than Europeans may be because we

pay so little in them and get comparatively so little for them in return. If we

paid more taxes like the Europeans do, and then got many more important and

obvious social and economic benefits, we would probably see the connections

between taxes and government benefits more clearly – and so resent our taxes

less. Strange but true.

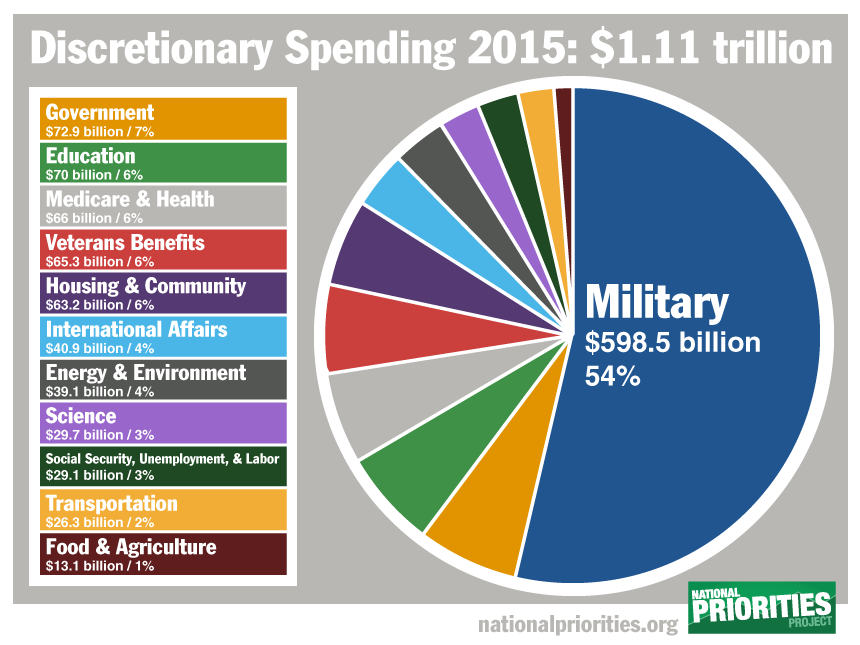

A major reason we get so little for our taxes is that half of

our tax revenue goes to war. Recently, my wife was questioned about this statistic

by her students. They told her that their professors said only 25% of our taxes

go to the military. That’s because they were using the government pie chart

that includes social security payments as a tax. Social security is not a tax

but a pension plan that pays back the money it takes out of payroll. What we

pay to social security cannot be used for any purpose other than retirement

benefits. The pie chart below shows what is called “discretionary

spending.” This is a more accurate way of assessing how our tax dollars are

prioritized. As you see, half of our discretionary taxes go to fight wars.

I did a little research and discovered that Belgium pays the

highest tax rate in Europe. A Belgian earning $100,000 per year pays on average

$34,000 in taxes. An American earning $100,000 pays only $24,000 per

year--$10,000 less. But the Belgian gets free health care, which now costs

Americans an average of $10,000 per year. In addition, Belgian also receives

free higher education, which costs Americans between $9,500 and $32,500 per year,

depending on whether you go for a private or public university. I don’t want to

imply Belgium is perfect. Belgium promises housing for all, but still has a

homeless problem. So it’s not Utopia, but Belgium does a lot better than the

United States in providing economic security for most of its citizens. No one

in Europe goes bankrupt because of medical expenses. Around a million Americans

still go bankrupt each year because of medical bills. Before Obamacare, it was

around 2 million.

I did a little research and discovered that Belgium pays the

highest tax rate in Europe. A Belgian earning $100,000 per year pays on average

$34,000 in taxes. An American earning $100,000 pays only $24,000 per

year--$10,000 less. But the Belgian gets free health care, which now costs

Americans an average of $10,000 per year. In addition, Belgian also receives

free higher education, which costs Americans between $9,500 and $32,500 per year,

depending on whether you go for a private or public university. I don’t want to

imply Belgium is perfect. Belgium promises housing for all, but still has a

homeless problem. So it’s not Utopia, but Belgium does a lot better than the

United States in providing economic security for most of its citizens. No one

in Europe goes bankrupt because of medical expenses. Around a million Americans

still go bankrupt each year because of medical bills. Before Obamacare, it was

around 2 million.

Those who object to paying taxes to support the military

sometimes become tax resisters. My wife Kathleen was a Methodist minister with

Quakerish tendencies who tried this approach, but found that the IRS put a lien

on her bank account and charged her fines and interest. She decided it wasn’t

worth it. My hard-core peace activist friend David Hartsough is a tax resister

and considers the fines and interest simply the cost of having a conscience. I

respect David’s integrity, but I have chosen a different approach. I make sure

that on Tax Day I let my elected officials know how I want my taxes to be

spent.

Surveys reveal that American are generally clueless about how

their tax dollars are spent. Most underestimate how much is spent on the

military and overestimate how much is spent on welfare programs and foreign

aid. Recent surveys show that education

was named as a priority by 51% of Americans, followed by health care at 37% and

national defense at 30%. In other

words, most Americans would like their tax dollars allocated in ways similar to

how they are allocated in Belgium and other European socialist democracies.

Unfortunately, our elected officials have other priorities, based on the

priorities of their corporate sponsors and wealthy donors.

Ted

Cruz, for example, wants to do away with the progressive income tax and have a

flat tax. He appeals to populism: Wouldn’t you like to avoid hiring a tax

accountant and simply pay your taxes on a postcard? It sounds nice, but most

economic experts agree that a flat tax would cause a vast transfer of wealth

from the middle class to the 1%, and dry up the funding for most social

programs that help the poor. Cruz promises

to cut the government by two thirds by hiring only one government employee for

every three who retire or leave their jobs. This would suit the Koch brothers

and other Tea Partyers who believe that the only legitimate role of government

should be to fund the military, the police and prisons.

Today you have a chance to let your elected officials know how you'd like your

tax dollars spent. That's why I recommend that you go to fcnl.org. This site has all the information you need to make a difference.

Taxation is one of the government’s main sources of revenue and it uses tax money to pay for government workers and fund state-owned services like security or defense forces, healthcare, and education.

ReplyDeleteinheritance tax planners in London